In the rapidly evolving landscape of streaming services, Netflix has long been a dominant force. However, with increasing competition from platforms like Disney+, Amazon Prime Video, and HBO Max, the question arises: should Netflix consider reducing its prices to maintain its competitive edge? This article delves into the complexities of pricing strategies in the streaming industry, examining the potential benefits and drawbacks of a price reduction for Netflix. By analyzing market trends, consumer behavior, and financial implications, we aim to provide a comprehensive overview of whether a shift in pricing could be a strategic move for Netflix in this fiercely contested arena.

Evaluating Market Dynamics and Consumer Behavior

Understanding the intricacies of market dynamics and consumer behavior is essential for Netflix as it navigates its pricing strategy. Consumer preferences are continually evolving, influenced by factors such as economic conditions, technological advancements, and cultural shifts. With the proliferation of streaming services, competition has intensified, pushing Netflix to reassess its market position. Analyzing these dynamics involves examining:

- Price Sensitivity: Are consumers becoming more price-conscious, and how does this impact their subscription choices?

- Value Perception: How do consumers perceive the value of Netflix’s content library compared to competitors?

- Brand Loyalty: Is there a strong enough brand allegiance to justify current pricing, or does the potential for churn necessitate adjustments?

By evaluating these aspects, Netflix can better understand whether reducing prices might enhance its competitive edge or if alternative strategies could yield more sustainable growth. Strategic pricing decisions should reflect a balance between maintaining profitability and addressing consumer expectations in a dynamic marketplace.

Assessing Competitor Pricing Strategies

When evaluating how other streaming services structure their pricing, it’s crucial to consider the nuances of each strategy. Disney+, for instance, leverages its strong franchise portfolio to justify its pricing tiers, while Amazon Prime Video often bundles its service with other Amazon perks, adding perceived value. Hulu offers a tiered approach, allowing users to choose between ad-supported and ad-free experiences, catering to diverse consumer preferences.

Key factors to consider in these strategies include:

- Value Proposition: How do competitors justify their pricing through content exclusivity or additional services?

– Consumer Flexibility: Are there customizable options that appeal to different budget levels?

– Market Positioning: How does pricing reflect their brand identity and market goals?

By examining these elements, Netflix can determine whether price adjustments could enhance its competitive edge or if alternative strategies might better align with its long-term objectives.

Analyzing Financial Implications for Netflix

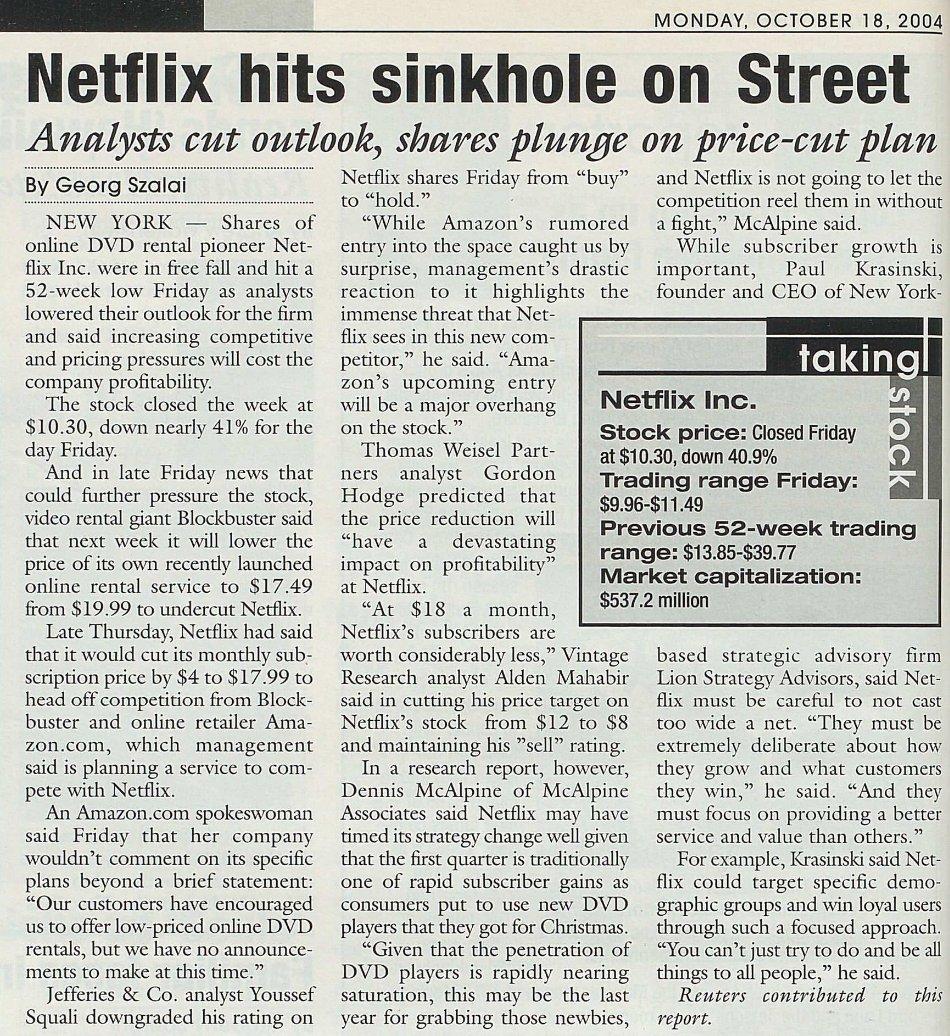

When considering a price reduction, Netflix must carefully evaluate the potential impact on its financial health. A key factor is the balance between subscriber growth and revenue loss. A lower price point could attract a broader audience, potentially increasing the subscriber base. However, the immediate reduction in revenue per user might not be offset by the new subscribers gained, especially if the existing user base also shifts to cheaper plans.

Key financial considerations include:

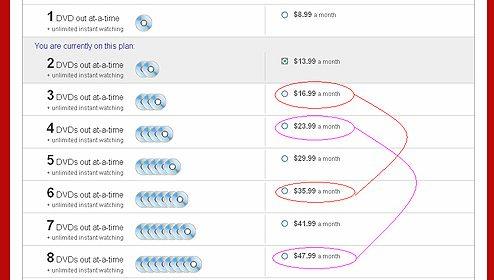

- Revenue Impact: How a change in pricing could affect total revenue, considering both current and potential subscribers.

- Content Budget: Maintaining a robust content library requires substantial investment. Reduced prices might limit available funds for new productions.

- Competitive Analysis: Understanding competitor pricing strategies and market positioning is crucial to determine if a price cut will enhance or dilute Netflix’s value proposition.

Exploring Potential Benefits and Risks of Price Reduction

In the dynamic world of streaming, adjusting prices can be a double-edged sword. Lowering prices might attract a broader audience, making Netflix more accessible to potential subscribers who were previously deterred by cost. This strategy could also enhance customer loyalty among existing users by offering more value for money. Furthermore, a price cut might position Netflix favorably against emerging competitors, drawing attention away from other platforms.

However, there are inherent risks. Revenue loss is a primary concern, potentially impacting Netflix’s ability to invest in original content, which is a significant differentiator. Additionally, frequent changes in pricing could lead to brand instability, causing confusion or mistrust among consumers. The balance between maintaining profitability and remaining competitive is delicate, and Netflix must carefully assess whether the long-term benefits outweigh the potential drawbacks.